by Jared West

Reddit is an incredible platform for all your queries and questions. It won't be an exaggeration to call it a goldmine of information as all the info provided on the website is by experts. Reddit seems a complicated website on the first look, but you can't give up on such a fantastic platform!

There are a lot of unusual phrases that show up on the website, like subreddits, upvotes, downvotes, threads, etc. Let's tell you a few things you need to know about Reddit. The most important thing to know is subreddits. Subreddits are channels or categories of different topics to choose from. The subreddits offer a wide variety of topics from politics, fun, and even Tinder! How to search for subreddits? Subreddits are denoted by r/topic like r/Funny, r/WorldNews, r/PersonalFinance, etc.

Contents

Created in 2009, r/PersonalFinance on Reddit is by far the largest subreddit about money. You get to see a lot of options about personal finance like budgeting, saving, investing, retirement plans, and many more. This is what makes r/PersonalFinance brag almost 14 million subscribers. Significantly because all the suggestions are by experts, so people seem to trust them more.

Let's share a few of our favorite PersonalFinance subreddits on Reddit:

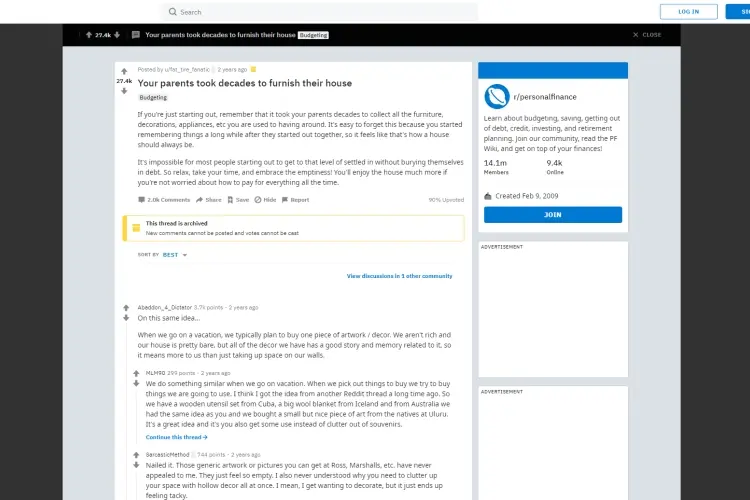

You must have experienced it and thought it would have taken quite less time to make or furnish a home than what it took your parents. But let me tell you, it is not true! Sometimes we look at people around us, earning money and living a great life where we are not standing at any particular place in our lives. And it feels like we have been left behind. Let me assure you. If you are making the effort of your choice, no way you are going to be left out of what others are achieving. Your goals might be different than theirs. So, your way and time to reaching your goal are going to be different too.

That is what is the heart and soul of this thread:

It's your choice to either wait for things to come to you at the right pace. Or cut on your expenses and live a low-grade life to achieve all of it suddenly. It took your parents time to buy the decorations and appliances etc. because they were busy giving you a good life too. So patience and effort is the key to success.

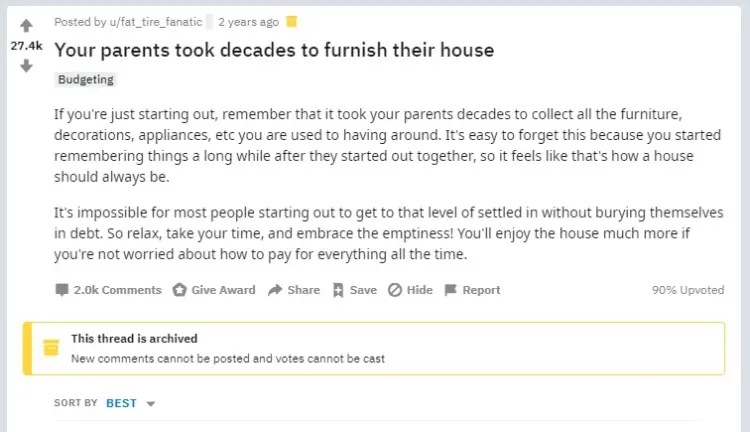

You go for car insurance or membership, and the agent usually asks you what you want your monthly payments to be. Then tells you that this much is your down payment, and you'll be paying the rest in this much monthly. But the question stays. What is the final price ? Cause the agent might cut you on a minimal monthly amount, which you'd be paying for years. Yes, a lot of people fall for this trap, but you should always bargain the final price before the agent fools you into paying a small monthly amount for half of your life.

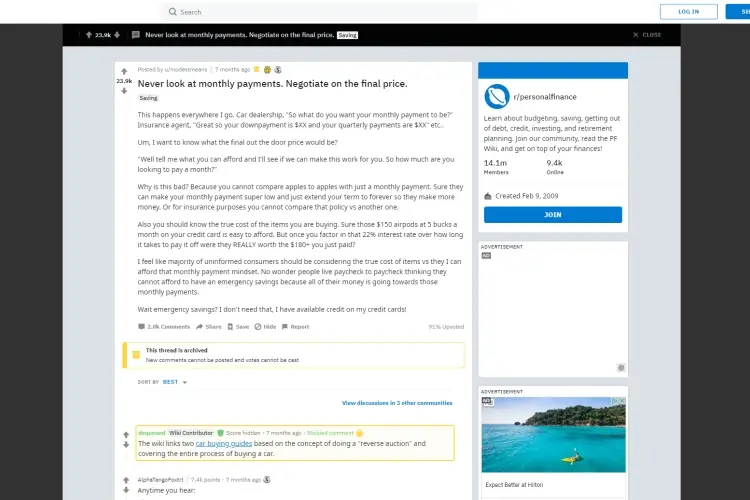

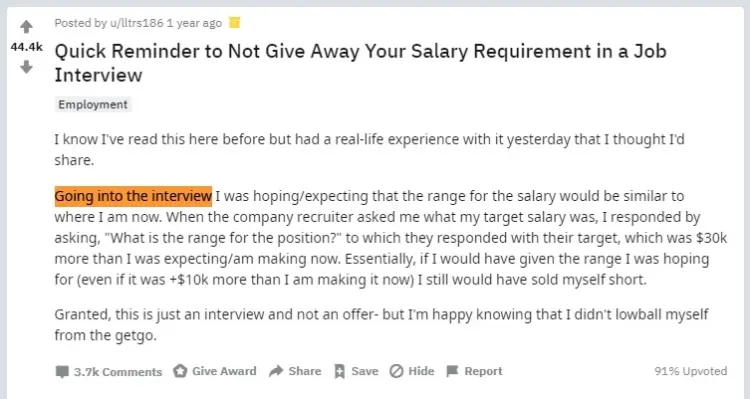

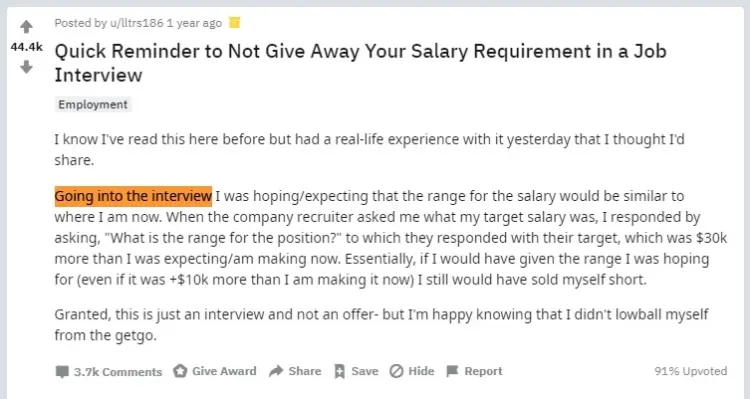

This thread on r/PersonalFinance is a jackpot! A lot of us make this mistake while going for an interview that we tend to tell the employer our expected salary. Sometimes you might be expecting a higher salary, whereas that organization or firm cannot afford that. Thus they do not consider hiring you; rather they opt for someone willing to work in their pay scale.

On the other hand, sometimes, you might be expecting a lesser pay, whereas the firm has more to offer. Yes, it happens more frequently as you think. Just like the OP (Original Poster) mentioned:

The OP is right that even if you are mentioning a salary that is $10k less than what the company has to offer, you are selling yourself short . And later, when you find out that people around you in the same position are getting a massive $30k more, it does feel bad.

So, always let the interviewer tell you what salary they are offering, and then you can decide if it is right for you or not!

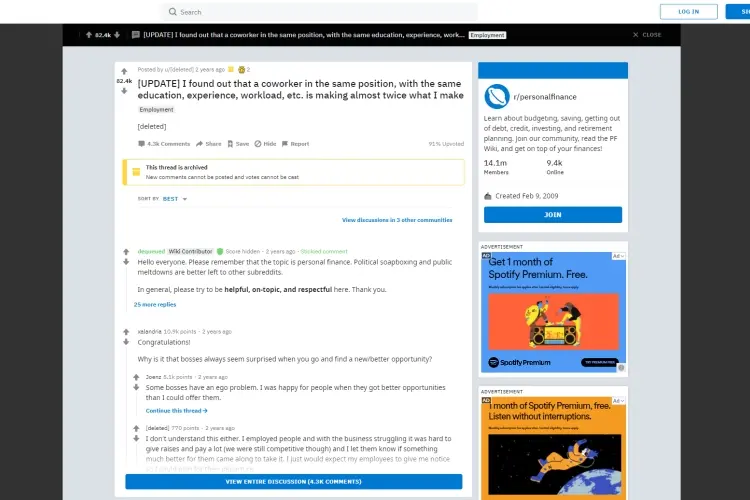

This sentence is as hurtful as it seems. Imagine working in a firm that is paying a newbie more than you are getting paid. It is horrible. Not if the person deserves it, but if they have the same education and abilities but lesser experience, it does not seem very fair. When the OP approached her boss, he had nothing appropriate to tell other than twisting the scenario. She ultimately left the job and found one that paid her much more than the previous. A few things that can help you save yourself from any such thing is to Know your worth and Negotiate mercilessly . What do you think would have happened if the OP had not left the job? She would have been in the same situation for a more extended period. But she decided because she knew her worth. She knew that is not worth what they had been paying her. Don't you think she could have kept quiet even after she knew her worth? But she negotiated, which landed her in a much better place. This is the value of self-worth and negotiating for your skills.

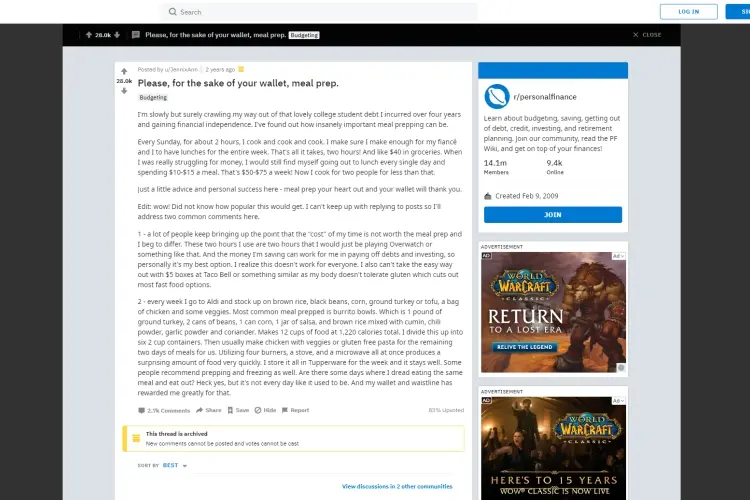

The OP has posted about her weekly activity of cooking every Sunday for 2 hours just to save some money. And that is one brilliant idea, isn't it? She says that she is trying to get rid of her college loans slowly and try to save some money on the go. It is a great advice undoubtedly that preparing meals in a few hours that are good for a whole week is amazing! Just say that you spend a minimum of $10 a week for a single meal that you eat out during the day. The amount sums to $50 weekly. This is the minimum as per the OP. If you go for other options they might be ranging up to $20 for a single meal too. So, if you are preparing food at home, the groceries for two people would roughly cost $40 which is indeed a good deal. If not a lot, you are saving little every week which can be huge if calculated annually.

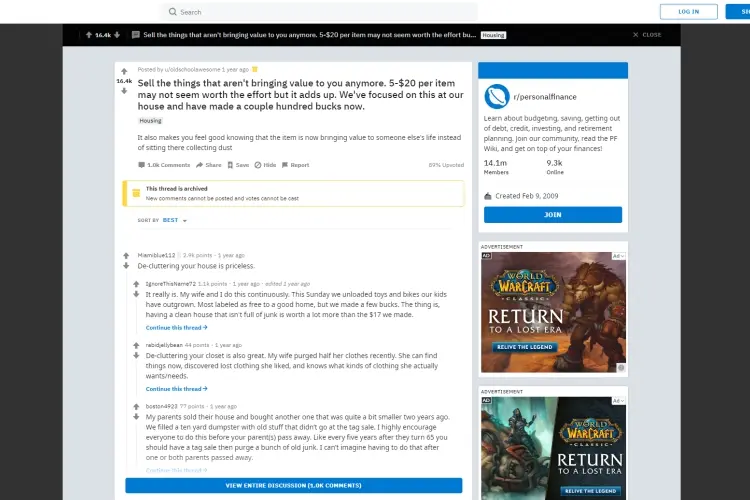

Another great advice I found on r/PersonalFinance is Decluttering. Decluttering is a great way to earn some bucks and set them aside. You might be wondering that the useless stuff is not going to get more than $20 per item at most, but if you are getting it without much effort, what's the harm in it. Not only it lets you save little cash side by side; it also enables you to get rid of extra stuff lying in the house that is of no use to you. As the OP mentions:

"It also makes you feel good knowing that the item is now bringing value to someone else's life instead of sitting there collecting dust."

It is right that something that is of no value to you might be an asset to someone. It is also considerable if you want to declutter for charity, but you can also make money through it.

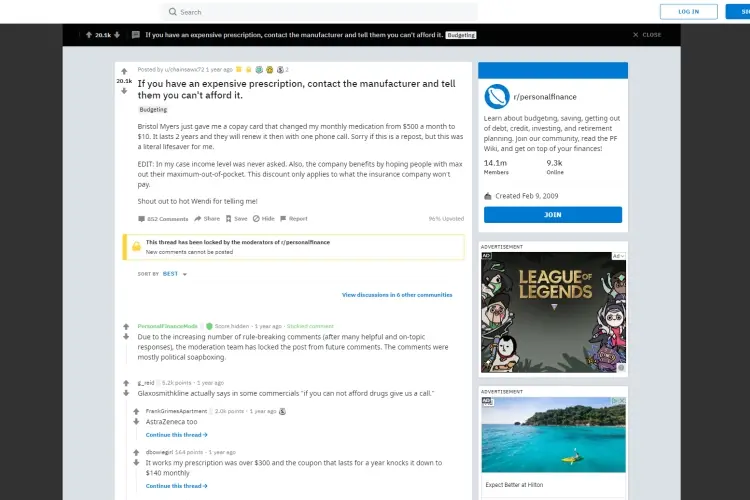

Unless you live in stone-age, you'd know that health insurance in the US can be hefty. Though you can save some money off hands by contacting the manufacturer and telling them about your unaffordability. This is a great help if you have a long-term or chronic condition that frequently needs expensive medicines.

As the OP says:

You can also try your luck and find a discount on your medicines if they are not insured.

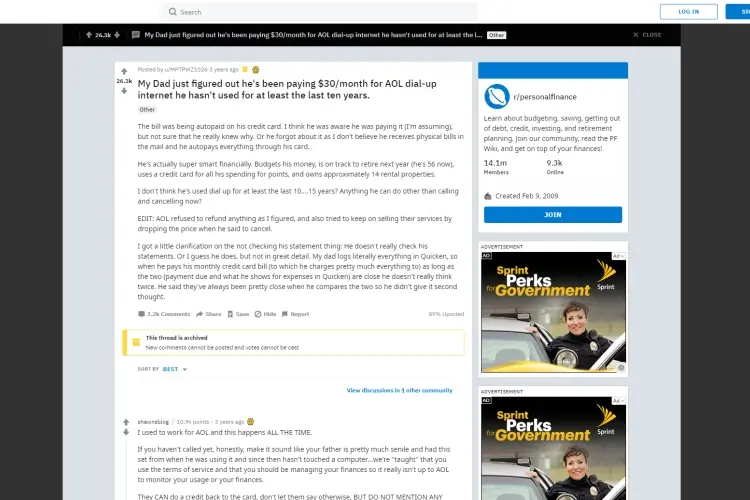

One of the worst things for your personal finance is paying for subscriptions you never use! The OP edited the thread to add that her father does not check his bank statements. And mates, that is the simplest solution to keep a check on unused subscriptions. Her father could have saved $3,600 for his retirement with the money he paid for those 15 years. Checking the monthly bank statement would take only 3 minutes, but they can help you save hundreds of Dollars!

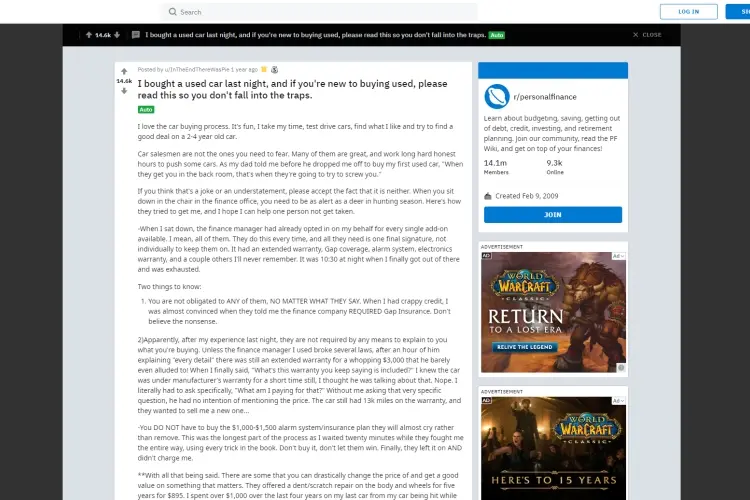

Many of us like to change the car we drive, every now and then but can't afford a new car every time. So what do we do? We end up buying a second hand car. When buying a second hand car always be sure about what you are being sold. Two important things that the OP mentioned is that you do not have to buy the add-ons they offer you with the car. Secondly, you'll not be told everything about the car so ask openly. Put all the questions up-front so you don't have any doubts later. Another thing to know is that the dealers usually ask you for an extended warranty options and you tend to choose the cheapest one. But tell them that you don't need any of them. This is just another tactic of making money. If you don't like their terms, walk away. Don't push yourself into buying the car only because it looks good!

These threads are a few among so many with excellent pieces of advice. Download Reddit for Android or iOS and read these fantastic threads yourself for some great pieces of information on Personal Finance.

About Jared West

Jared's unique approach to audio writing involves meticulously crafting intricate sound designs that serve as the foundation for his narratives. Through careful selection and manipulation of sound effects, ambient noise, and music, he weaves together a tapestry of auditory sensations that bring his stories to life.

|

|

|

|

Check These Out

Time for FREE Giveaways, and Free Gifts to show our gratitude.

Reveal all teh data by disbling adblock. Hit a button below to show all

|

|

|

|